Fed Interest Rate Decision

Crypto Inflows Are Back

Ethereum Bombshell Update

And more…

This Update Is Brought To You By Bitbo

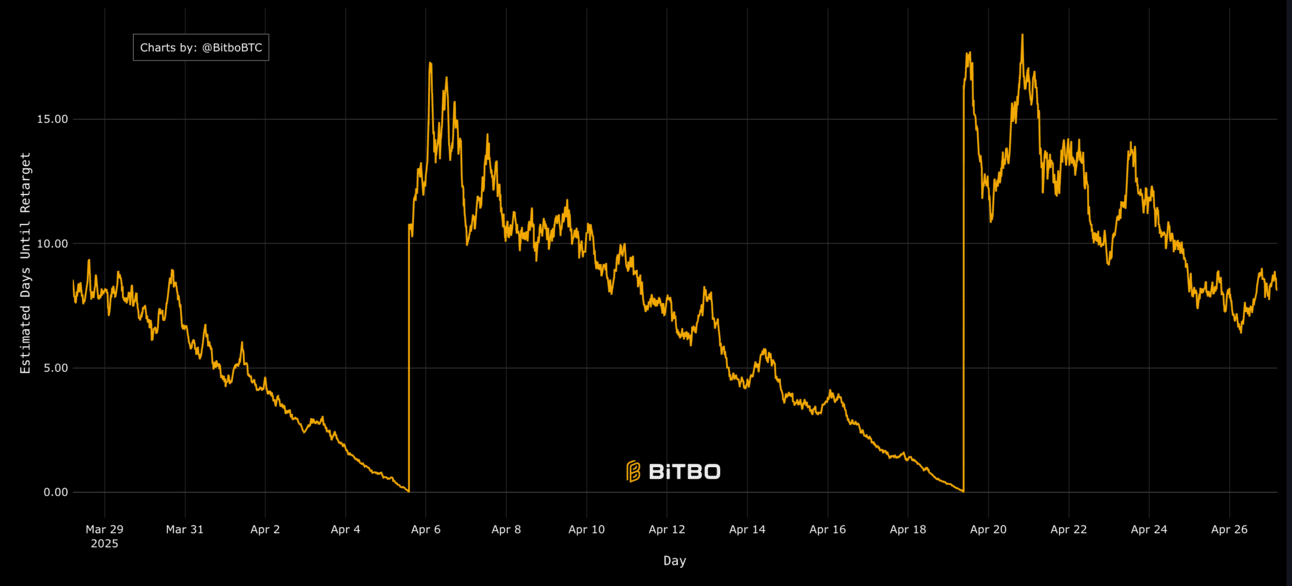

We are excited to announce one of Bitbo’s newest trading charts:

This chart shows the estimated time until the next difficulty re-target.

FED INTEREST RATE DECISION

The Federal Reserve is widely expected to lower its benchmark interest rate today, even after the release of hotter-than-expected inflation data.

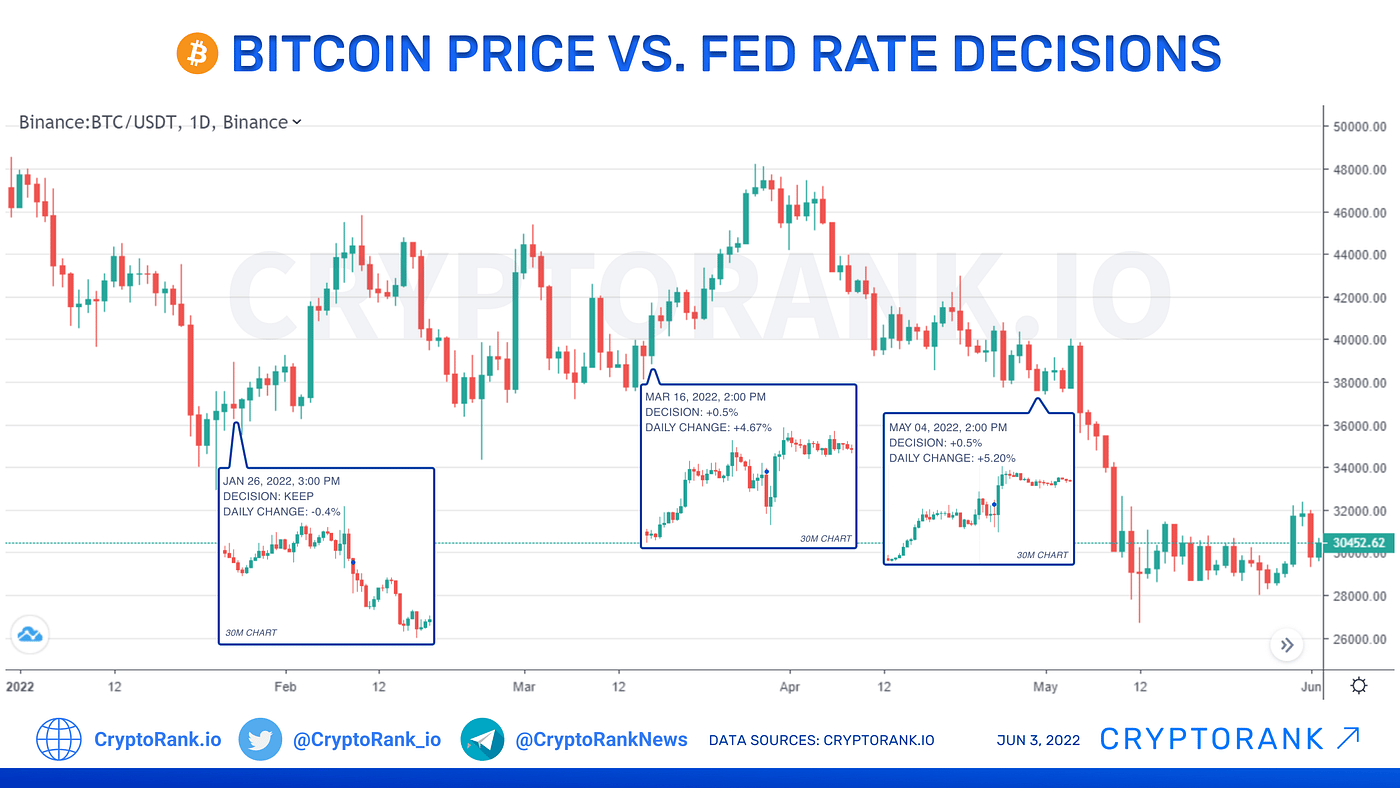

Historically this has been a major bullish driver for the price of bitcoin (see chart below)

According to the CME FedWatch Tool, the market is pricing in a 96% chance of a 25 basis-point rate cut this month.

“The betting is that the Fed will start cutting rates, concerned about downside risks in the economy—especially in the job market,” said Mark Hamrick, Bankrate’s senior economic analyst.

The federal funds rate, set by the U.S. central bank, is the rate at which banks lend to each other overnight. While it’s not the rate consumers directly pay, the Fed’s actions still impact credit cards, auto loans, mortgages, and even savings account interest.

A Federal Reserve (Fed) rate cut can have multiple effects that may benefit cryptocurrencies, though the relationship is indirect and influenced by broader market sentiment.

Recent data indicates that Bitcoin has shown resilience and upward momentum following Fed rate cuts.

For instance, after a recent rate cut was anticipated, Bitcoin's price surged above $114,000, reflecting a pattern where rate cuts often lead to increased investor interest in risk assets like Bitcoin:

Source:TradingView

Let’s break it down clearly:

1. Cheaper Borrowing Costs

When the Fed lowers interest rates, borrowing money becomes cheaper for businesses and consumers.

Investors may take on more risk since low-yield traditional assets (like savings accounts and bonds) are less attractive.

Cryptocurrencies, often seen as higher-risk, higher-reward assets, can benefit as capital flows from traditional markets into crypto.

2. Increased Liquidity

Rate cuts often come alongside policies that inject liquidity into the financial system.

More liquidity means more cash is available for investment, including speculative markets like crypto.

Historically, periods of lower rates have coincided with bullish trends in equities and crypto alike.

3. Weaker Dollar / Inflation Expectations

A rate cut can weaken the US dollar because lower rates reduce the return on dollar-denominated assets.

A weaker dollar can drive interest in alternative stores of value, including Bitcoin, which is often framed as “digital gold.”

Traders may also see crypto as a hedge against inflation if lower rates are expected to boost prices in the economy.

4. Investor Sentiment and Risk Appetite

Lower rates often signal an accommodative Fed, aiming to stimulate growth.

This can improve investor confidence, encouraging risk-on behavior—people are more willing to invest in volatile assets like crypto.

5. Historical Examples

March 2020: The Fed cut rates to near zero in response to the COVID-19 crisis. Bitcoin and other cryptos initially dropped in the short term due to panic, but the subsequent liquidity surge fueled a massive bull run in late 2020.

2022–2023 Rate Hikes vs. Cuts: When the Fed was raising rates, crypto markets struggled. Hints of future cuts often correlate with rebounds.

Key Caveat:

While a Fed rate cut can be bullish for crypto, it’s not guaranteed.

Short-term reactions can be volatile, especially if the rate cut is due to a weakening economy. Market psychology, regulation, and macro trends still play a huge role.

Bitcoin Well is at the forefront of the financial revolution, bridging the gap between traditional banking convenience and the transformative power of Bitcoin.

Their mission? To enable independence through automatic self-custody solutions.

What We Offer:

200+ Bitcoin ATMs across Canada

Online Portal for buying, selling, and using Bitcoin (available in Canada and USA)

Bill pay services

Lightning Network support

Gift card options

Cash vouchers

CRYPTO INFLOWS ARE BACK

And just like that… digital assets are on fire again.

Digital asset funds attracted $3.3 billion in inflows last week, signaling a sharp return of investor optimism.

Breaking it down:

Total flows

Bitcoin led the comeback with $2.4 billion — its largest weekly inflow since July — as sentiment swung decisively upward.

Ethereum ended its eight-day streak of outflows, pulling in $645.9 million.

Even Solana joined the party, hitting its largest inflow day ever on Friday with $145 million, closing the week near $200 million.

Flows by Country

The U.S. dominated with $3.2 billion in inflows, while Germany added $160 million and Canada $14 million.

Switzerland and Sweden bucked the trend, seeing outflows of $91 million and $5.6 million, respectively.

Late-week price strength pushed total assets under management to $239 billion, just shy of August’s peak at $244B.

We’re officially back. 🚀

ETHEREUM BOMBSHELL UPDATE

Fundstrat CEO, Tom Lee just dropped a bold prediction: Bitcoin at $250K, Ethereum at $62K by the end of the year.

His argument?

Every time Bitcoin makes a historic move, Ethereum follows with an even sharper breakout.

With ETH already powering DeFi, tokenization, and payment systems, Lee says it’s only a matter of time before it leaves past highs in the dust.

He calls this moment the perfect storm for digital assets—structural demand colliding with crumbling legacy finance.

If Lee is right, we’re about to witness the biggest crypto bull run of all time.

Find out more from Tom Lee in the video below:

OTHER NEWS

Italian Bitcoin communities drive grassroots adoption through local meetups, educational initiatives, and merchant outreach, focusing on monetary sovereignty and privacy 🏛️

Bitcoin Core governance defended against industry influence with transparent structures, independent oversight, and strict donor agreements 🛡️

Brazilian Bitcoin archetypes foster resilience via coordinators, market pragmatists, monetary purists, and minimalists ⚖️

US policies favor stablecoins over Bitcoin as government measures strengthen the dollar rather than advance Bitcoin 💵

Removing OP_RETURN limits protects decentralization while addressing blockchain storage concerns 🔗

Bitcoin Core v30 vs. Bitcoin Knots sparks adoption debate over data carrier size and network spam concerns 📊

Bitcoin treasury companies face scrutiny over legitimacy, valuation, and long-term sustainability 🏦

Covenant soft forks could reduce risk and improve privacy contrary to some opposition, enabling trustless alternatives 🔒

US Treasury crypto privacy proposals clarify reporting rules rather than banning mixers or similar tools 📝

AI-driven energy demands a shift to decentralized macrogrids to build an 'Internet of Energy' that outpaces China’s renewables ⚡

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.