Can Bitcoin Keep Delivering Explosive Gains? 💥

Bitcoin’s Market Potential - What Ark Invest Are Saying

El Salvador’s Bitcoin Strategy Is Working Too Well

And more…

Market Data Prices as of 5:00am ET

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

CAN BITCOIN KEEP DELIVERING

EXPLOSIVE GAINS?

Many of us want to see our money grow, but tracking the latest investment trends or assessing risks isn’t easy.

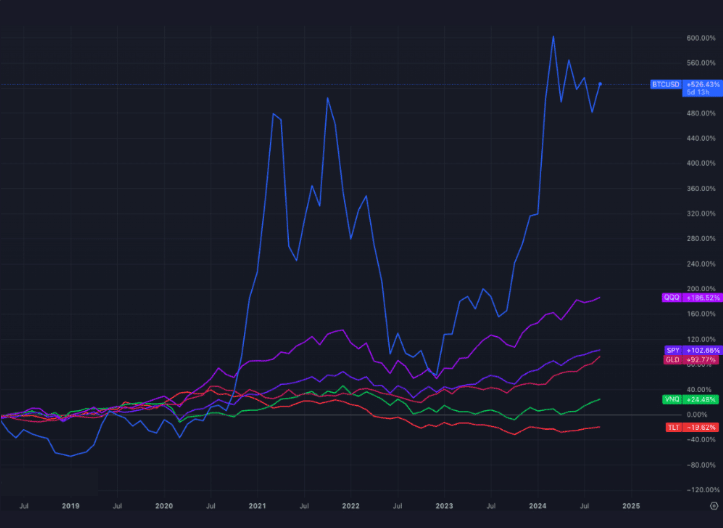

Most people leave that to financial advisors who create portfolios across asset classes like U.S. blue chips (SPY), real estate (VNG), and increasingly, Bitcoin (BTC). 📈

Here’s why that matters: Since 2018, Bitcoin has exploded by over 526%, outshining almost every other major asset class.

And if we’re being honest, 2018 wasn’t Bitcoin’s best year.

Even when starting from a low, Bitcoin’s performance crushes the competition.

Yes, there’s volatility, but hold it long enough—three years, to be exact—and Bitcoin consistently comes out on top. That’s a major signal, no?

We could talk about how Bitcoin is becoming a strategic asset for countries or how big corporations are adding it to their balance sheets.

But today, we’re talking about pure performance—the kind that creates FOMO.

You feel it, right? 🤗

Still, investing isn’t just about following emotions. The big question is whether Bitcoin will continue its massive gains.

In this Newsletter, we dive into the analysis from one of the biggest names in the space—Ark Invest—to understand what the future holds.

BITCOIN’S MARKET POTENTIAL:

WHAT ARK INVEST ARE SAYING

Ark Invest was one of the first institutional-grade analysts to release a detailed report on Bitcoin back in 2020.

At the time, Bitcoin was trading at $10k with a market cap of $220 billion, and Ark boldly predicted it could 15x to $150k by 2030.

Fast forward to today, Bitcoin sits at $62k with a $1.3 trillion market cap, edging closer to that target as economic conditions continue to favor its growth.

Ark's ability to forecast with precision led us to revisit their predictions and explore how they reached their ambitious conclusions.

Their insights on Bitcoin's market potential are incredibly valuable in understanding where the crypto giant might head next.

In today’s article, we’ll cover:

Ark Invest’s bold 2020 prediction and how it played out

What this reports tell us about Bitcoin’s growth potential

Our own Bitcoin price prediction for 2030

Let’s kick things off with Ark Invest’s breakdown of how Bitcoin could capture major market share in the years to come.

1. Bitcoin’s Role in Global Settlements

Bitcoin is evolving beyond just being a store of value or digital gold. According to ARK Invest, Bitcoin could become a revolutionary global settlement network. Here's why this development could change the future of transactions:

Borderless and Always On: Unlike traditional financial systems like Fedwire, which operate on fixed hours and rely on intermediaries, Bitcoin works 24/7, without geographic boundaries. It facilitates peer-to-peer transactions without the need for middlemen, reducing costs and speeding up cross-border settlements.

Censorship Resistance: In contrast to traditional payment systems that can block or reverse transactions due to regulatory oversight, Bitcoin is censorship-resistant, ensuring that no third party can interfere with or halt a transaction. This gives users full control over their financial operations.

Massive Market Potential: The U.S. alone generates $1.3 quadrillion in annual settlement volume. If Bitcoin captures even 10% of this market, it could drive its market cap to $1.5 trillion (see below)

The concept of Bitcoin as a global settlement network is not just theoretical—it has the potential to reshape how value is transferred across borders and industries.

2. Bitcoin as a Hedge Against Asset Seizure

In regions with weak property rights or heavy government intervention, Bitcoin is emerging as a key defense against asset seizure. Here's how ARK Invest sees Bitcoin offering a solution to individuals in these environments:

Seizure Resistance: Because Bitcoin operates on a decentralized network, no central authority, including governments, can control or confiscate it. As long as users manage their keys properly, their wealth remains secure.

Inflation Protection: Governments often erode wealth through inflation. As fiat currencies lose value, Bitcoin’s fixed supply provides a natural hedge, protecting assets from currency debasement.

Growing Market Opportunity: If individuals in regions prone to asset seizure allocate just 5% of the global monetary base (excluding major currencies) to Bitcoin, its market cap could soar to $2.5 trillion (see below).

For people in politically unstable regions, Bitcoin offers a decentralized and secure way to store wealth that’s beyond the reach of governments and inflation.

3. Bitcoin as the New Digital Gold

With growing interest from both retail and institutional investors, Bitcoin is positioning itself as the modern version of gold. ARK Invest sees Bitcoin not only rivaling gold but potentially surpassing it as a superior store of value.

Scarcity & Durability: Like gold, Bitcoin is scarce and durable. However, it overcomes some of gold’s major limitations by being more divisible, portable, and easily transferable across the digital economy.

Verifiability & Security: While gold requires effort to verify its authenticity, Bitcoin can be instantly verified through the blockchain, making it a more secure and less vulnerable asset.

Market Potential: The global gold market is valued at over $10 trillion (now $18 trillion). If Bitcoin captures just 10% of this market, its market cap could rise by $1 trillion (see below).

As the global economy shifts toward digital assets, Bitcoin is well-positioned to become the preferred vehicle for wealth preservation, competing directly with physical gold.

4. Bitcoin as Inflation Hedge in Emerging Markets

In economies struggling with inflation and poor monetary policy, Bitcoin is emerging as a powerful tool for individuals seeking financial stability. ARK Invest highlights the potential of Bitcoin as a hedge against inflation in these regions.

Protection Against Inflation: With local currencies rapidly losing value due to hyperinflation, Bitcoin provides a reliable store of value, safeguarding wealth in a way that fiat currencies cannot.

Financial Independence: Bitcoin's decentralized nature ensures that it remains beyond government control, offering individuals in unstable regions the ability to manage their wealth with greater autonomy.

Growth Potential: If Bitcoin captures even 5% of the monetary base in emerging economies, its market cap could jump to $1.2 trillion, showcasing its substantial potential in these markets.

In regions where economic policies falter, Bitcoin could serve as a vital asset, protecting individuals from financial collapse and inflation.

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Speak to one of the specialists at Swan Bitcoin today.

Swan has built incredible tools to allow you to measure the impact that Bitcoin could have on your portfolio.

Book A Swan IRA Consultation - 15 min

Check out the Swan retirement calculator and plug in your details to measure the potential of Bitcoin in your retirement account.

EL SALVADOR’S BITCOIN STRATEGY IS WORKING TOO WELL

IMF Urges El Salvador to Reconsider Bitcoin Laws Amid Loan Talks

The International Monetary Fund (IMF) has expressed concerns over El Salvador's bold Bitcoin policy, suggesting it might be time to scale things back.

In negotiations for a new loan program, the IMF has raised the issue that El Salvador’s decision to adopt Bitcoin as legal tender is creating roadblocks.

The IMF recently advised the country to "narrow" its Bitcoin law, pointing to the cryptocurrency's associated risks as a reason for the delayed progress in talks.

IMF Director of Communications, Julie Kozack, stated:

“We’ve recommended a more limited scope for the Bitcoin Law, enhanced regulatory oversight, and reduced public sector exposure to Bitcoin."

However, El Salvador's Bitcoin experiment has had remarkable results.

Since its adoption, the country has seen a 10% increase in GDP, a significant rise in tourism, and around $65 million in unrealized gains from Bitcoin holdings.

Despite these achievements, the IMF remains wary, citing concerns over financial stability, and suggesting that Bitcoin's volatile nature could pose risks.

OTHER NEWS:

EIGEN Layer assures users infrastructure is secure after investor loses $6M in email hack. EIGEN Layer reassured users that its infrastructure remains secure amid isolated 1.67 million token theft from email breach.

BTC short-term holders 'likely taking on more risk' as realized cap drops by $6B. Short-term holders seem to be turning bullish on Bitcoin as Q4 2024 begins.

Bitcoin, Gold Could Benefit From Rising Geopolitical Tension and U.S. Election: JPMorgan. Geopolitical risk and the upcoming U.S. election are likely to reinforce the 'debasement trade,' to the benefit of both bitcoin and gold, the report said.

U.S. moves to seize $2.7 million from Lazarus hacks traced through Tornado Cash, other mixers. Two recent forfeiture actions filed by the U.S. Attorney for the District of Columbia have uncovered new details about how North Korean crypto hackers launder their funds.

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.