Crypto Storm Not Over Yet

Bitcoin Still A Bargain At $60K. Here’s Why..

2008 Banking Crash Was So Different

And more…

Market Data Prices as of 3:00am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $61,202 | +0.68% | +44.75% |

Ethereum (ETH) | $2,682 | +2.06% | +17.56% |

Solana (SOL) | $145 | +2.00% | +43.46% |

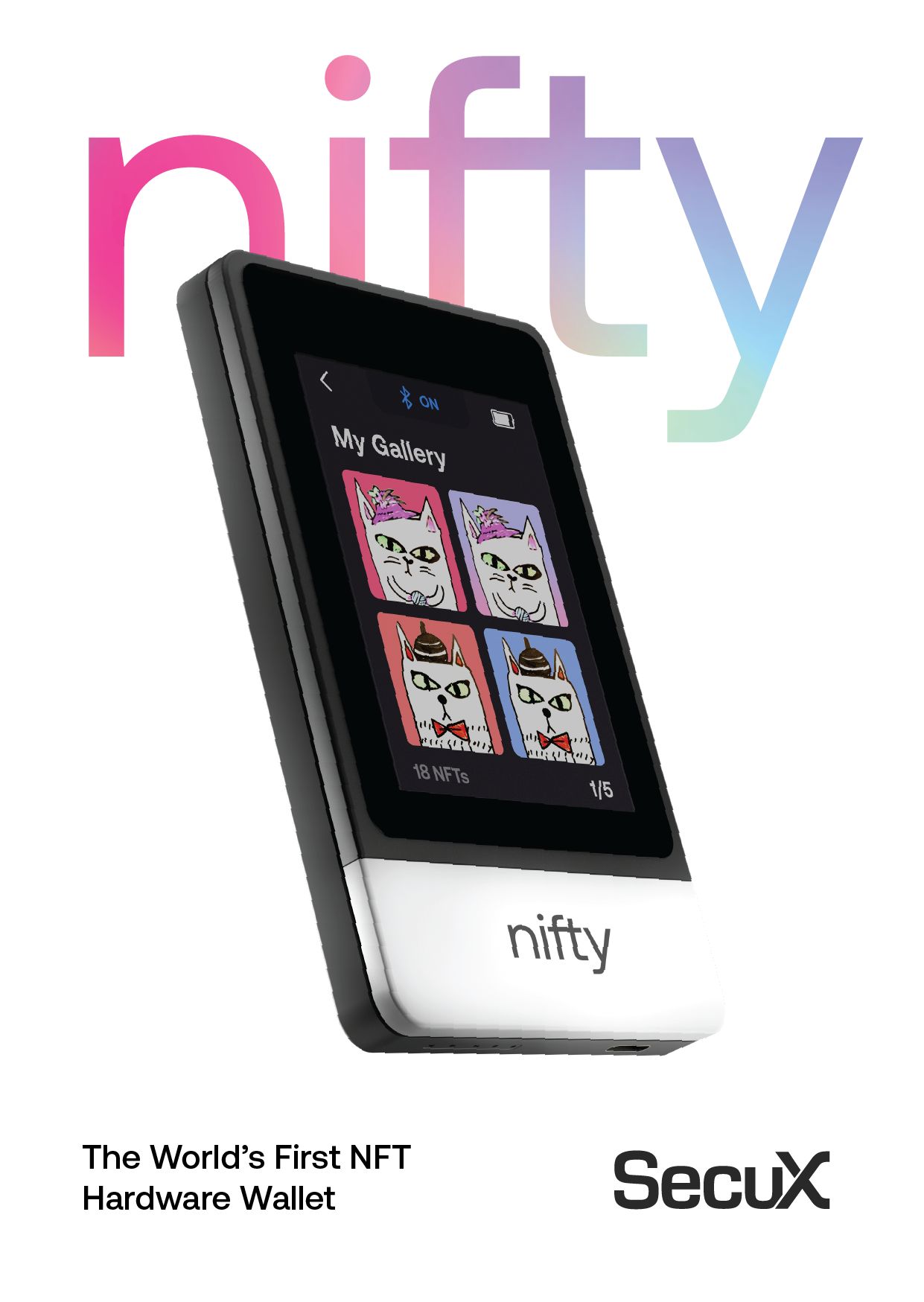

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

CRYPTO STORM NOT OVER YET

We’re in the thick of a crypto storm, but there’s hope on the horizon as the skies start to clear.

The $BTC and $ETH markets have been inundated with new supply and selling pressure.

The main contributors to this storm include:

Grayscale’s $ETHE ETF: High fees are driving investors to sell.

Mt. Gox: Repayments to creditors from the 2014 collapse are flooding the market with $BTC.

German Government: Selling off seized $BTC.

U.S. Government: Rumoured to potentially sell $BTC seized from Silk Road.

Miner Selling Pressure: We are currently in the longest period of Miner Capitulation in Bitcoin’s history

Typically, the market can withstand one or two points of selling pressure. But three or more? That’s when things get challenging (👈 exactly where we find ourselves).

But there’s light at the end of the tunnel: 124k of the 227k $BTC expected to be sold has already been absorbed by the market.👇

We’re not out of danger yet, and more selling events could arise. However, the current $BTC supply overhang seems to be diminishing.

This is crucial because:

Bitcoin is the key driver of the market’s long-term direction.

Buyers tend to shy away when there’s a looming wall of publicly tracked selling pressure (though these concerns are slowly subsiding).

Market Outlook: The market may continue to grind sideways as it digests the remaining known supply. But once these clouds disperse, we can expect a resurgence in investor confidence.

All of this then begs the question, is Bitcoin still a good price at $60K?

Take a look at this next article to find out….

BITCOIN STILL A BARGAIN AT $60K.

HERE’S WHY…

MEET THE BITCOIN ‘POWER LAW’…🛸

—A revolutionary pricing model that has redefined how we understand Bitcoin’s price movements.

This model was unveiled by Giovanni Santostassi, an Italian astrophysicist, in 2019.

Santostassi discovered that Bitcoin is subject to power laws, indicating that its behavior resembles that of a physical system rather than a conventional asset.

This theory emerged after noticing a pronounced power law relationship over many orders of magnitude in the correlation between Bitcoin’s price and time.

As you can see in the chart below, Bitcoin price spends half of its time in each of these two bands:

This chart represents two specific Bitcoin price bands:

A resistance band that sits above the current market price

A support band that sits below the current market price

The resistance and support bands are derived using a linear regression model on historical Bitcoin prices, which generates a "power law." This "power law" is a straight line that demonstrates the connection between Bitcoin's price trajectory and time. This line is then duplicated twice, with the same slope, to form two new bands.

This discovery has been nothing short of transformative for Bitcoin analysts.

Since its introduction, the Bitcoin Power Law Model has predicted Bitcoin’s price with an astounding 99% accuracy, making it a go-to tool for many investors, including Fred Kreuger whose updates we have covered here previously.

According to the model, the fair market value of Bitcoin today is $74,000.

This means Bitcoin is currently available at a 20% discount, signalling that it may still be an opportune time to invest.

Looking forward, the model projects that Bitcoin could soar to between $200,000 and $300,000 by 2025.

If the model’s accuracy persists, this cycle could be one of the most profitable yet for Bitcoin holders.

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

RAOUL PAL: 2008 BANKING CRASH WAS SO DIFFERENT

In a recent discussion with Market Disruptors Raoul Pal delved into the cyclical nature of global markets, focusing on the repercussions of the 2008 economic crisis and the shift towards a debt-based economy.

Pal discussed the 'Everything Code' thesis, a concept where global asset cycles align in a 4-year pattern, influenced by presidential elections and Bitcoin halving cycles.

The conversation explores themes of decentralization, the emergence of AI and robotics, and the possibility of a technological renaissance.

The speakers underscore the necessity of understanding these cycles for making informed investment choices in a rapidly evolving economic landscape.

Key Takeaways:

📉 The 2008 financial collapse was a key moment that exposed the dangers of high debt levels, necessitating major government interventions to stabilize the economy.

🌐 Since the 2008 crash, the global economy has shown increased synchronization, largely due to the coordinated efforts of central banks, creating a persistent 'debt refinancing cycle' that influences asset values and policy-making.

💡 The idea of the 'Everything Code' reflects a closer alignment of various economic cycles, shaped by the debt cycle and monetary strategies.

🚀 Advances in decentralized technologies, including AI and renewable resources, could reshape traditional power structures and open new avenues for economic growth.

💰 The importance of entrepreneurial spirit and innovation is reiterated as essential for addressing issues and generating value in a swiftly changing environment.

🌿 As technology becomes more prevalent, the importance of natural human experiences is rising, suggesting an increased demand for genuine, person-to-person interactions.

💡 The discussion stresses the importance of safeguarding digital assets like Bitcoin, given the risks associated with storing them on exchanges or insecure devices.

🔄 The cyclicality of economic markets is a key theme, with the suggestion that recognizing and understanding these cycles is vital for crafting effective investment strategies.

🚫 The script challenges the expectation of an upcoming 'big crash', arguing that the current economic model, burdened by high debt, would not support such a downturn.

🌟 The concept of an 'economic singularity' is hinted at, where traditional economic indicators such as GDP may lose significance due to technological and AI developments.

🕊️ The conversation concludes on a positive note, emphasizing human adaptability and the continuous importance of human innovation amid rapid technological transformations.

Take a look at some of the highlights from the discussion here:

WHAT WE’RE READING…

Parker Lewis argues that Bitcoin's fixed supply creates a perfectly elastic available supply, enabling its viability as a medium of exchange and driving its emergence as a global reserve currency

Henry Fisher of Cake Wallet writes about the launch of Silent Payments, a new Bitcoin feature that enhances user privacy and allows organizations to receive donations without revealing their identity or transaction history

River, Bitcoin-only exchange, publishes a post detailing how the establishment of a Strategic Bitcoin Reserve could enhance America’s financial stability, address the federal debt crisis, and position the U.S. as a leader in global Bitcoin adoption

Ilan Alon of the College of Management argues in The Jerusalem Post that Israel must ‘seize the moment’ and embrace a more Bitcoin-friendly stance in order to unlock ‘unprecedented opportunities while avoiding the pitfalls that other nations have encountered’

@icecakes reveals in a Stacker News post how he uncovered a scammer generating BTC addresses via WalletGenerator.net that they had the private keys for, but then gave the user an uncorrelated private key

Ryan Gentry of Lightning Labs assesses the last-mile solutions for the Lightning Network, emphasizing improvements in wallet and blockchain interactivity to enhance self-custodial user experiences in Bitcoin payments

Michael Degroot, a financial professional, highlights Vancouver's thriving Bitcoin economy as he and his colleague complete over 30 lightning transactions in one day, showcasing Bitcoin as a viable medium of exchange across more than 80 local businesses

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.