Bitcoin Slumps To $60K

Fed Rate Cuts Will Push Bitcoin To $400K

Bitcoin Market Top - The Only Way Is Up

And more…

Market Data Prices as of 6:30am ET

This Update is Brought to You by Heatbit

Heatbit Trio is the world’s only heater-purifier that mines Bitcoin at 10 TH/s and makes you ≈30,000 SATS / mo

BITCOIN SLUMP TO $60K - WHERE TO NEXT?

BREAKING: Rising conflicts in the Middle East have led to widespread market instability, triggering $489 million in crypto liquidations.

The much-anticipated "Uptober" didn’t start as planned.

As Middle East tensions escalated, investors moved away from risk assets, causing Bitcoin to drop during US trading hours.

At the time of writing, Bitcoin is down 3.45%, trading around $61,000.

Bitcoin ETFs saw $242.6 million in outflows yesterday. This was the largest outflow since Sept. 3.

The market drop wasn’t limited to cryptocurrencies.

The S&P 500 also fell by ~1.18%.

This isn’t the first time we’ve seen such a reaction. Similar market dips occurred in April 2024:

And again in August 2024:

On both occasions, Bitcoin made a strong recovery.

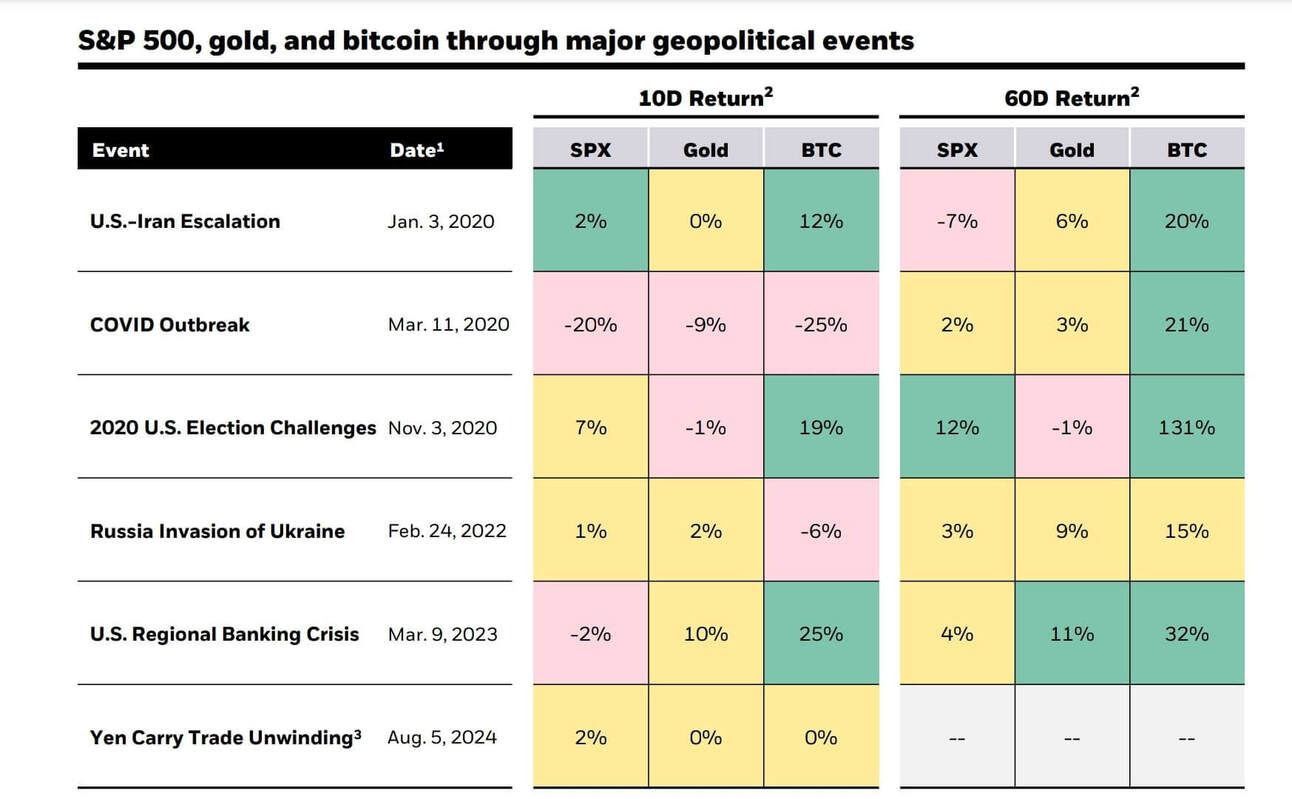

According to a recent research report from BlackRock, Bitcoin has a history of bouncing back from geopolitical events within days or weeks, sometimes even exceeding prior levels.

Right now, today’s dip of ~3.45% is notable, but Bitcoin remains impressively resilient, showing strong signs of holding its ground.

We’ll keep you updated!

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

FED RATE CUTS WILL PUSH

BITCOIN TO $400K

In a recent announcement, Zap CEO Jack Mallers revealed exciting insights into Bitcoin’s performance in relation to fluctuating interest rates.

He emphasized that lower rates are usually advantageous for assets like Bitcoin, presenting a prime moment for the cryptocurrency to thrive.

Mallers recalled how, when concerns over dollar liquidity intensified, the 10-year Treasury bond rate approached 5%, causing Bitcoin’s price to skyrocket from $20,000 to $70,000 within five months.

He remains confident that Bitcoin will soon make another leap, this time from $70,000 to an astounding $400,000.

Take a look at some of the clips from the interview here and hear about Jack’s long term outlook for Bitcoin:

Stay Ahead of the Trend in Digital Assets with Glassnode

Join Glassnode and Access a suite of metrics which describe the foundational components and performance of the Bitcoin blockchain. Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

BITCOIN MARKET TOP - THE ONLY WAY IS UP

Need a bit of positive market sentiment to end today on a high note?

Look no further.

Julien Bittel, the Head of Macro Research at Global Macro Investor (GMI), recently posted a chart on X that’s catching the attention of Bitcoin investors.

This chart tracks a key on-chain metric that signals when Bitcoin is approaching a cycle top—and its accuracy is truly impressive.

Just glance at the chart and see how well these spikes coincide with previous cycle peaks for Bitcoin.

Right now, the metric indicates we’re nowhere near a top, meaning there’s potentially a lot more room for Bitcoin’s price to climb.

Of course, if you’re like us, you probably want to know how this crypto metric is calculated.

Unfortunately, the details are locked behind a $20,000 per year subscription fee.

While we may not have access to the precise data, the chart remains an interesting indicator to keep an eye on.

Let’s hope Julien’s reading of the market is on target and we see Bitcoin continue its upward journey.

The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

OTHER NEWS:

Mt. Gox creditors are nearing long-awaited bitcoin payouts after the 2014 collapse, which saw 850,000 BTC stolen. About 160,000 BTC is being distributed, sparking market speculation. While some fear a sell-off, many creditors plan to hold, and bitcoin’s maturity could limit market disruption.

Bitcoin dropped nearly $4,000, or over 3%, following Iran’s missile strike on Israel. Gold prices rose 1.4% to $2,665 per ounce. This renewed debate over Bitcoin as a safe-haven asset, with analysts suggesting investors are favoring gold during geopolitical tensions.

Business Insider claims both Trump and Harris are courting Bitcoin voters. However, Trump has actively supported the crypto industry, while Harris has remained silent. Trump has made specific pledges to Bitcoin holders, while Harris has yet to express any meaningful stance on the issue.

A new mystery about Bitcoin's creator, Satoshi Nakamoto, has emerged, highlighting missing blocks in early 2009. Analyst Wicked Bitcoin found gaps in the “Patoshi” miner’s activity, sparking speculation that Satoshi may have tested Bitcoin’s resilience to 51% attacks. The discovery adds to the enduring enigma surrounding Nakamoto.

Ohio Senator Niraj Antani introduced a bill allowing residents to pay state and local taxes using Bitcoin. This follows a 2018 attempt to integrate cryptocurrency for tax payments. The bill also permits state universities and pensions to invest in digital currencies, aiming to modernize Ohio’s financial system.

CME’s Bitcoin Friday Futures (BFF) launched with 31,498 contracts traded on the first day, making BFF the most successful crypto futures debut to date. Sized at one-50th of a Bitcoin, these cash-settled contracts expire weekly, allowing participants to hedge or speculate on Bitcoin's short-term price movements without long-term commitments.

Bitcoin ETFs saw $242.6 million in outflows yesterday. This was the largest outflow since Sept. 3, as BTC dropped 6% to $60,300. The decline was driven by escalating Middle East tensions, snapping an eight-day streak of inflows.

North Korea infiltrated over a dozen crypto firms. North Korea did this by covertly hiring IT workers, using fake identities and passing interviews. These hires violated sanctions and exposed firms to hacks, with stolen earnings funneled to Pyongyang. A CoinDesk investigation revealed widespread DPRK involvement in altcoin projects like Sushi and Cosmos Hub.

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Cryptosovereignty - Erik Cason

Liberty and Property - Ludwig Von Mises

The Conservative Case For Bitcoin - Mitchell Askew

Debt: The First 5000 Years - David Graeber

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.