The Bitcoin King Is Back

5 Essential Visuals For Every Crypto Investor

“Hidden” Banking Crisis Is Super Bullish For Bitcoin

And more…

Market Data Prices as of 4:00am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $58,782 | -0.33% | +38.91% |

Ethereum (ETH) | $2,309 | -0.31% | +1.23% |

Solana (SOL) | $132.65 | +0.73% | +30.67% |

This Update is Brought to You from MindLabPro

The world's most advanced nootropic formula.

Designed to boost your everyday brainpower. For enhanced cognitive function and peak daily performance.

11 premium-grade research-backed nootropic nutrients.

100% plant-based & stim-free. In prebiotic vegan capsules.

For focus, clarity, memory, mood, motivation & more.

THE BITCOIN KING IS BACK

BREAKING: MicroStrategy Doubles Down with $1.1 Billion Bitcoin Purchase

In a move that further solidifies its position as a leading institutional investor in Bitcoin, MicroStrategy has added 18,300 Bitcoin to its portfolio.

This purchase, valued at $1.11 billion, was made at an average price of $60,408 per Bitcoin, bringing MicroStrategy’s total Bitcoin holdings to an astounding 244,800 BTC.

To date, the company has spent approximately $9.45 billion on Bitcoin, with an average acquisition price of $38,585 per Bitcoin.

As a result of this aggressive investment, MicroStrategy stock rose by 8.18% on the same day the news was announced. The purchase was financed by the sale of more than 8 million shares via an agreement with financial institutions.

Despite these impressive numbers, some market observers remain sceptical about MicroStrategy’s Bitcoin strategy, raising concerns about the long-term implications of tying corporate assets so closely to a volatile asset.

However, with unrealized gains of over $5.3 billion on its Bitcoin holdings, the company has clearly seen significant upside.

Interestingly, the announcement had an immediate impact on Bitcoin’s price, which surged above $60,000 shortly after the news broke.

Could this be the start of a renewed bull run for Bitcoin?

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign

⭐ Refer a friend and grab up to 30 USDT

⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

5 ESSENTIAL VISUALS FOR

EVERY CRYPTO INVESTOR

Skipping instructions might work for DIY furniture, but it’s a fast track to failure in crypto investing.

If you’re serious about building wealth, here are five key visuals you need to keep in mind:

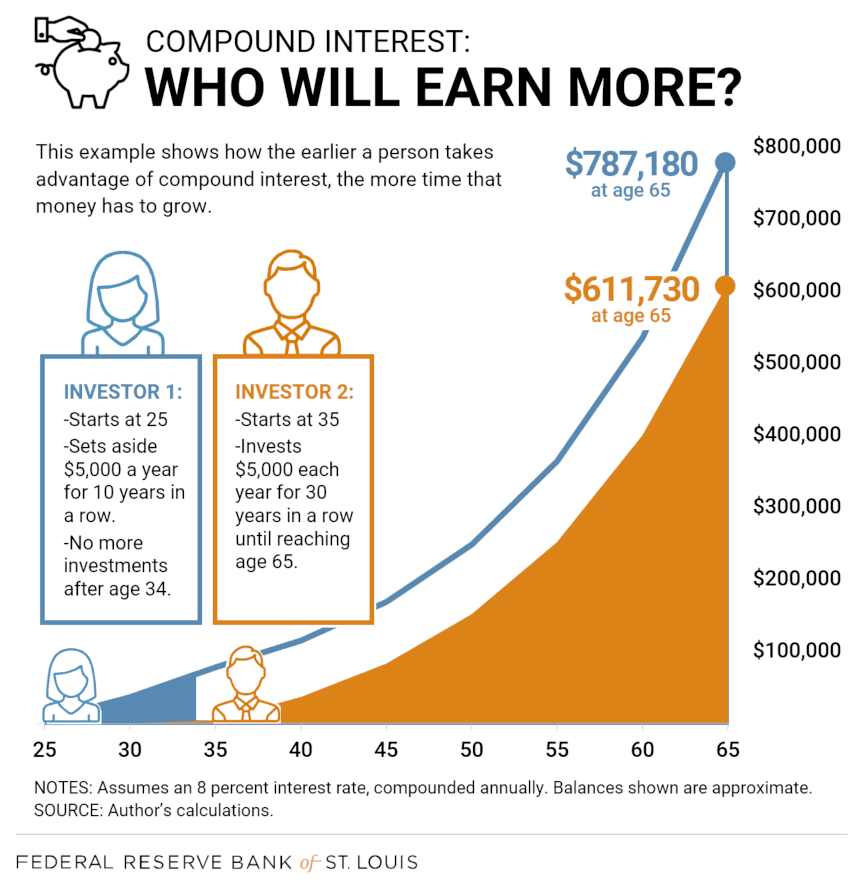

Start Early: The Power of Compound Growth

In investing, the earlier you start, the better. The concept of compounding is your best friend in the long game. Start early, and watch your investments grow exponentially over time—like landing that dream summer house in The Hamptons! 🌅

Avoid Buying Tops and Selling Bottoms

One of the biggest rookie mistakes is buying at the top and selling at the bottom. Learning to read market trends can prevent unnecessary losses. By tuning into the market’s signals, you can avoid making emotionally-driven decisions that could cost you dearly.

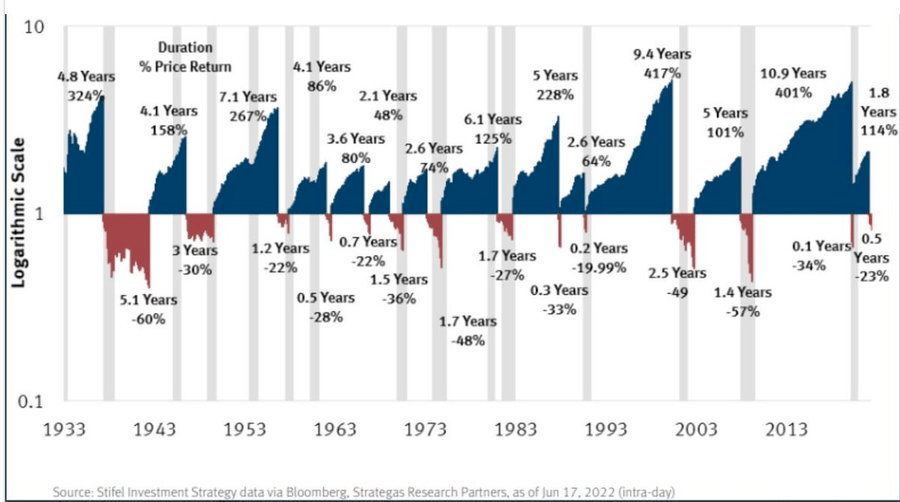

Bear Markets Are Short, Bull Runs Are Long

While bear markets can be painful, they’re typically shorter than bull runs. Keeping this perspective will help you stay calm during market downturns. The best investors know how to hold through the rough patches and come out stronger on the other side.

Reinvest: The Power of Compounding Returns

Reinvestment is where the magic happens. Compounding can take small, regular investments and grow them into something huge over time. Even if you can’t double your money every day, consistent growth at 10% annually could make you a millionaire in 30 years.

Investing vs. Trading: The Long Game Wins

Most billionaires didn’t get rich from short-term trading. They built wealth by investing for the long term. If you want to build significant wealth and have more free time, focus on being a long-term investor, not a day trader.

Just look at Warren Buffett—he built his fortune by picking solid assets, creating a diversified portfolio, and holding onto them for years.

Stay Ahead of the Trend in Digital Assets with Glassnode

Join Glassnode and Access a suite of metrics which describe the foundational components and performance of the Bitcoin blockchain. Metrics cover supply, on-chain activity, transfer volumes, mining performance, and transaction fees.

Robert Kiyosaki, author and financial educator, has once again expressed concern over the state of the global financial system, pointing to the over-reliance on debt in the form of bonds.

According to Kiyosaki, this debt-driven economy is unsustainable, with major consequences looming on the horizon.

In a social media post, Kiyosaki highlighted the inherent risks of the bond market, noting that while governments use bonds to sustain the economy, they are ultimately debts.

Kiyosaki remarked, hinting at a potential financial collapse:

“A bond is debt, and the whole world is floating on it,”

Kiyosaki emphasized the difference between market crashes and banking crashes, explaining that the latter are often hidden and pose a greater threat to the economy.

With fears of a recession growing, especially in the US, Kiyosaki advises a shift toward physical assets like Gold, Silver, and Bitcoin.

His sentiments are shared by other leading voices in the financial world, including Michael Saylor, who predicts a future surge in Bitcoin's value to as high as $13 million.

Here are some more clips of Robert Kiyosaki discussing why it is essential to hold some Bitcoin in your investment portfolio:

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

OTHER NEWS:

BlackRock calls Bitcoin a hedge against geopolitical instability and a growing alternative to traditional currencies

Solo bitcoin miner again wins $180K reward by mining block 860749, even amidst record hashrate highs

Norway introduces legislation to regulate data centers and stifle bitcoin mining

Fractal Bitcoin, supported by Unisat, launches its mainnet with a unique scaling solution using Bitcoin Core code to enhance transaction capacity and speed

Fractal Bitcoin captures over 240 EH/s in its first 24 hours, reshaping the Bitcoin's hashrate landscape

MARA acquires more Bitcoin, now owns over 26,200 BTC worth $1.5B, and won’t be selling any soon

Kraken no longer supports Lightning withdrawals for German clients

NBA legend Scottie Pippen excites his 670,000 X followers with a bullish tweet on Bitcoin

FOR THE FERTILE MIND…

You are what you read! Here is what we are reading right now…

Cryptosovereignty - Erik Cason

Liberty and Property - Ludwig Von Mises

The Conservative Case For Bitcoin - Mitchell Askew

Debt: The First 5000 Years - David Graeber

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.