The Banana Zone Is Still On

Take a Step Back: ‘Sell in May and Go Away’

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $61,455 | +0.28% | +45.88% |

Ethereum (ETH) | $3,441 | +1.80% | +47.64% |

This Update is Brought to You By Swan Bitcoin

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

THE BANANA ZONE IS STILL ON

BREAKING: Why This Investment Pro Has Full Conviction in a Massive Bitcoin Move to the Upside

If you've been involved in the crypto space for a while, you've probably encountered the term banana zone.

Coined by macroeconomic expert Raoul Pal, the banana zone refers to a phase in the crypto cycle where global liquidity surges, causing crypto prices to experience a parabolic rise.

The chart below shows the previous three cycles, where the Bitcoin Price has taken a sudden and exponential move upwards - in the shape of a banana!

Recently, Raoul announced that we were on the verge of entering the banana zone.

However, in the past 30 days, we have observed crypto prices either falling or stagnating, with Bitcoin dropping below $60,000 at one point and several altcoins plummeting.

This scenario raises the question: "Where is the banana zone?"

In his latest live stream, Raoul provided some insights, presenting nine different charts that explain why he remains confident that the banana zone will emerge within the next three months.

The first chart he shows is the overbought, oversold indicator which shows that the bull run has really only just begun.

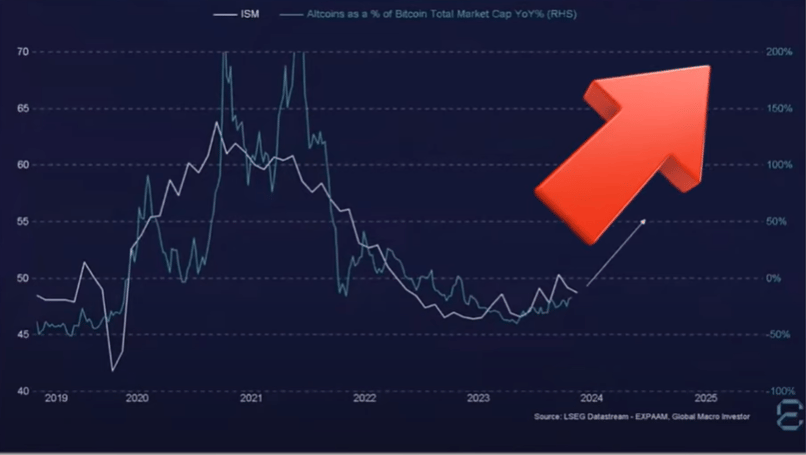

The second chart he breaks down is the ISM survey overlaid with the altcoin market in which they closely track each other.

All forward-looking indicators suggest that the ISM is going to head higher, which also means that the altcoin market should follow.

The third chart is the Fed Net Liquidity Chart. In simple terms, when the Fed starts printing money, assets massively outperform, which is great news for Bitcoin and crypto.

The chart suggests that a good amount of that liquidity will enter the crypto space, with a high chance of prices ripping much higher within the next 12 months.

Watch this video where Raoul talks through a number of different charts which all point to the same conclusion

TAKE A STEP BACK: ‘SELL IN MAY AND GO AWAY’

The recent Bitcoin “crash” has caused some concern…

But sometimes it’s important to take a step back and appreciate the bigger picture.

That’s the latest insight from Anthony Pompliano.

Pomp In his latest interview, Anthony Pompliano contextualized Bitcoin’s recent price movements.

To start, Bitcoin is up 46% year-to-date.

It’s also risen over 100% in the last year.

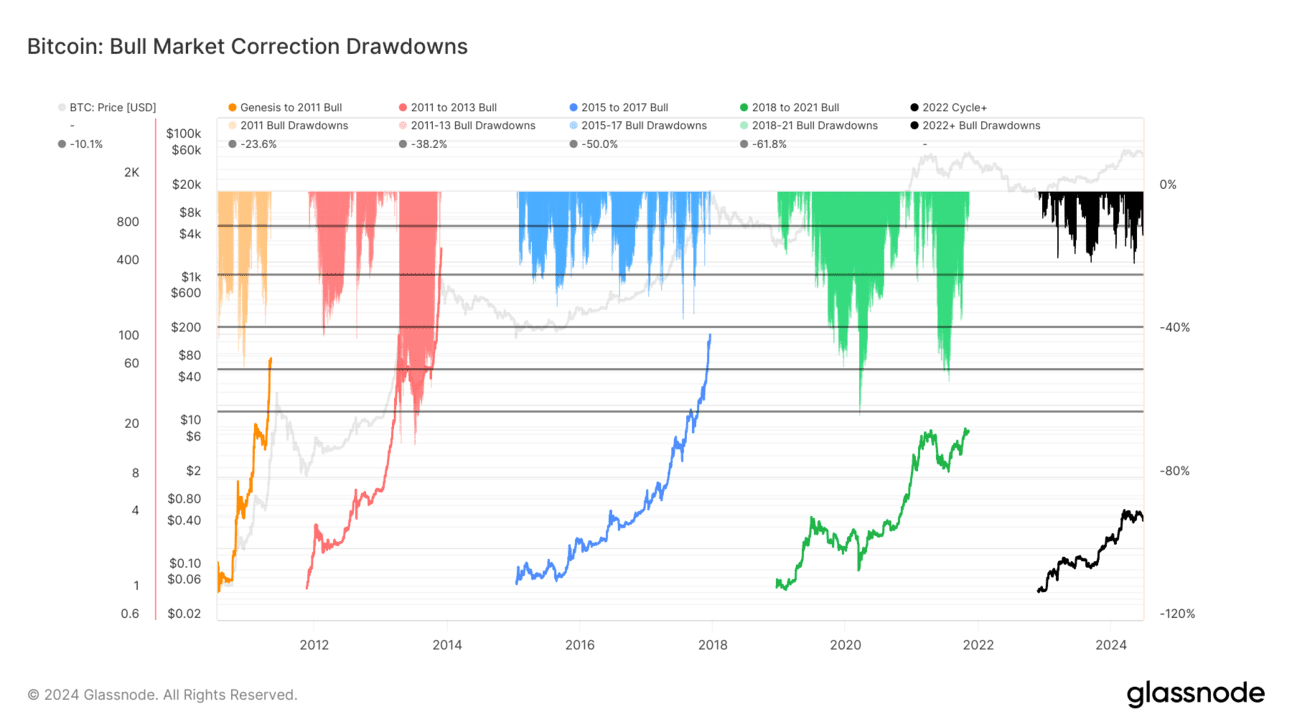

Historically, bull markets have experienced 4-6 drawdowns of 30% or more.

Currently, Bitcoin is only down about 20% from its all-time high.

The descending bars in the chart below illustrate the depth of past cycle corrections.

The black area highlights the current Bitcoin cycle.

As shown, the corrections we've encountered so far are minor compared to previous cycles (the last cycle saw corrections exceeding -50%).

On-Chain When viewed from this perspective, the situation doesn’t seem as dire…

“When an asset surges significantly, people begin taking profits. We’ve witnessed an explosive rally at the start of the year, and naturally, people are taking some of those profits.”

Anthony Pompliano references the common saying, “Sell in May and go away.”

Stocks typically trade sideways during the summer and pick up again around Halloween.

This pattern is currently evident in the crypto market.

Pompliano elaborates:

“People observe explosive movements at the beginning of the year, and Q4 tends to be a strong quarter for crypto. Q2 into Q3 usually sees sideways movement, which is what we’re witnessing now.”

Anthony Pompliano Concluding the interview, Pomp poses the question, “if you have cash, where do you invest it?”

His recommendation?

Bitcoin, of course.

“If you have cash, where else will you put it? The stock market or Bitcoin? Over the long term, what outpaces inflation? Bitcoin naturally emerges as one of the few viable options.”

Anthony Pompliano In times like these, it’s crucial to zoom out.

Bitcoin is still hovering around ~$61,000…

The best crypto app to secure your tokens: Ledger

A crypto wallet is a physical device, designed to enhance the security of your private keys by securely storing them offline.

These wallets physically store your private keys within a chip inside the device itself.

The beauty of using a crypto wallet is the security it provides to your private keys.

The big idea behind crypto wallets is the isolation of your private keys from your easy-to-hack smartphone or computer – basically anything that can expose your private keys

OTHER NEWS:

Cardano outsmarts DDoS attacker who ends up funding network improvements. Uncover the details of the DDoS attack on Cardano blockchain and how it was mitigated. Learn how the network protected staked tokens.

Crypto losses to deep fakes could reach $25B in 2024. AI deep fake scams could cause $25 billion in crypto losses in 2024 as the number of deep fakes has jumped, says Bitget Research.

Coinbase sues SEC, FDIC over FOIA requests, says federal regulators trying to cut out crypto. Crypto exchange accused federal financial regulators of trying to cut off the crypto industry from the banking sector in the complaints

Bolivia lifts ban on Bitcoin, authorizes crypto transactions via banks. The change in regulatory stance marks the end of a ban on crypto use in the country in place since 2014.