Are We Entering The Next Bull Market Phase?

The Macro-Economic Picture

8 Reasons To Be Bullish About Crypto

And more…

Market Data Prices as of 5:00am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $66,980 | -0.65% | +58.42% |

Ethereum (ETH) | $3,523 | +0.86% | +54.38% |

Solana (SOL) | $178.20 | -0.90 | +75.46% |

This Update is Brought to You By Swan Bitcoin

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

ARE WE ENTERING THE NEXT BULL MARKET PHASE?

This could be the last chance for "cheap" crypto buys!

An unusual market dynamic is unfolding. 👀

Stocks are climbing (orange), while crypto is diving (blue). Normally, crypto moves in tandem with stocks, so what's happening? 🤔

When the correlation between crypto and stocks dips below -0.8 (light blue bottom indicator), crypto often rallies shortly after.

Note the red dotted lines indicating previous instances of this pattern. 👆

Here's the key point: we're at a correlation of -0.84 right now. Does this signal the next major move? 👀

The divergence between rising stocks and falling crypto is evident. 🪟

The chart suggests that this could be an ideal time for crypto to gather steam.

Let’s now zoom out and take a look at the Macro Picture and see if it supports the chart above….

We are excited to introduce the Bybit Card to you!

⭐ Get 10 EUR card bonus upon sign⭐ Refer a friend and grab up to 30 USDT ⭐ Get 2% Auto-Cashback in USDT

There is no annual or monthly fees, you get instant virtual card, up to 8% APY and it's compatible with Google Pay!

Order a Bybit Card in just 5 minutes!

1️⃣ Sign up for a Bybit Account here

2️⃣ Complete your application

3️⃣ Receive your virtual card immediately

You get to earn rewards point as you spend too!

Rewards Point can be converted to USDT or redeemed exclusive merchandise

THE MACRO-ECONOMIC PICTURE

There are two possible paths to close the gap between stocks and crypto:

Stocks could follow crypto's lead and start to decline.

Crypto could follow stocks and begin to grow.

Considering crypto's relatively minor influence on the overall market, the more likely scenario is that crypto will follow the upward trend of stocks.

We believe this is the moment for the crypto market to not only close the gap but also to accelerate significantly higher.

But why do we have confidence in the continued rise of stocks? We need to consider two essential questions:

Where are we in the market cycle?

Is there new liquidity entering the market?

First, let's examine the market cycle.

The chart below shows the percentage of countries in each phase of the market cycle globally.

"Summer" represents the peak phase for investors, characterized by robust economic growth and prosperity, during which stocks and other investment instruments tend to perform very well.

% of Countries in Each Macro Season:

Currently, 87.5% of countries are in the "Summer" phase, meaning nearly 9 out of 10 nations are set for growth and prosperity.

Rising stocks are typically a reflection of thriving economies. 🌐

The message is clear: Sitting on cash might not be wise. Allocating money now could be a smart move since we are at a favorable point in the market cycle for growth.

But growth doesn't happen in a vacuum. Just as flowers need summer sun, the market requires fresh liquidity to thrive and push prices higher. Liquidity is the fuel that drives the market. So, how do we introduce new liquidity?

It's simple: by lowering interest rates and printing more money. Brrrrrrrr. 💸

The market generally expects the US to implement 2 or 3 rate cuts this year. Moreover, over 25% of countries have already started cutting rates, and 27 of 34 central banks are expected to begin easing by the end of the year.

% of Central Banks Cutting Interest Rates:

The trend shown in the chart above is clear. More central banks are beginning to ease monetary policy by lowering rates.

FED Chair Powell also mentioned that the U.S. economy is no longer overheated, strengthening the case for interest rate cuts. 🚀

Additionally, here's a chart indicating that when unemployment rises by more than 0.5% from its lows, the FED usually responds.

Fed Funds Rate Over Time:

Currently, unemployment has increased by more than 0.5%. Historically, the FED has responded to such increases with rate cuts. ✂️

Inflation has been the primary concern preventing the FED from cutting rates. However, looking at the chart of the US Core inflation rate, it's clear we're moving back towards normal levels.

US Core Inflation Rate:

The combination of falling inflation and rising unemployment makes rate cuts inevitable, which is excellent news for investors as it brings new liquidity into the markets.

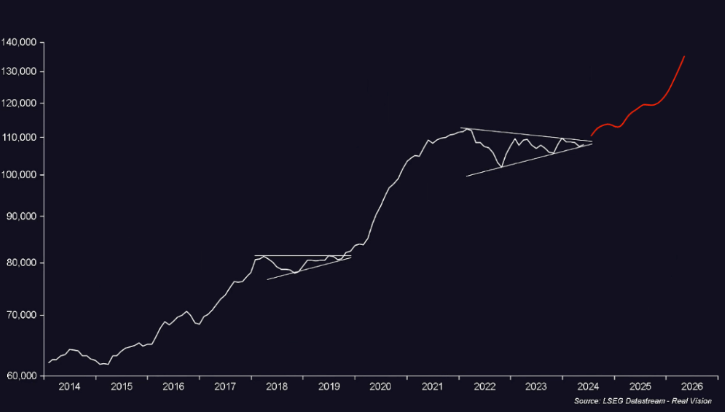

Here is the chart of global liquidity. We've added some helpful lines to show you where it's heading next. 😉

GMI Total Liquidity Index ($BN)

Consolidation triangles from 2018-2019 and 2022-2023 represent periods of market uncertainty about the next move. These patterns typically hint at a significant change on the horizon.

All indicators suggest the next move will be upward, as highlighted on the chart.

So, the macroeconomic and stock market outlook is highly positive. But what does this mean for crypto?

8 REASONS TO BE BULLISH ABOUT CRYPTO

1. Bitcoin ETF Flows Show Strength 🌊

The long-term impact of Bitcoin ETFs is often underestimated.

These ETFs provide a strong passive bid for the market, showing no signs of slowing down.

In July alone, there have been $2.15 billion in net inflows, compared to the approximately 9000 Bitcoin mined worth around $600 million.

2. The US Presidential Election

According to Polymarket, Trump has a 62% chance of winning the election.

A Trump presidency could be a positive catalyst for crypto, considering the recent support his administration has shown towards the industry.

This is not an endorsement, but rather an observation based on presented facts.

Historically, the Democrats have been strongly opposed to crypto.

3. Trump Speaking at Bitcoin 2024

Building on the previous point, Trump is scheduled to speak at the Bitcoin 2024 conference in Nashville.

Recently, Trump has made positive remarks about Bitcoin and crypto.

Dennis Porter, a campaigner for Crypto regulation and CEO of Satoshi Act Fund, explains on ‘good’ authority that Trump will use Bitcoin 2024 to make an announcement that he plans to use Bitcoin as a strategic reserve asset.

Whether he genuinely supports Bitcoin or is leveraging it for votes remains uncertain.

Nonetheless, it's a significant event that a presidential candidate is addressing a Bitcoin conference.

Remember to take the above update cautiously, as no official source has confirmed it yet.

4.The German Government is out of Bitcoin

As you probably know, the German government is out of Bitcoin now.

Over the past 3 weeks, they completely sold off their holdings of ~50,000 BTC.

The key thing here is that this was a one-off event.

The market can now move forward without this selling pressure looming.

5. Bull Market Cycle

Previous Bitcoin bull markets have lasted ~3 years.

And currently, we’re only ~1.5 years into this bull market.

The final year of the bull market is also typically the biggest.

Here’s what Mathematician and Wall Street veteran Fred Kreuger thinks will happen:

“I would say, to be conservative 2x. But it could be 4x, 6x, it could be some big number. There’s a lot of reason why, just from a bull market perspective, that we are in a very good position. And it’s not the time to take your chips off the table.”

The best way to summarize this point is with the chart below.

Bitcoin’s price historically has gone absolutely bananas in the final year of the bull market.

"The transition to Macro Summer is relatively forecastable due to the repeating cycle...Again The Everything Code."

Macro Investor and CEO of Real Vision Finance, Raoul Pal, has also repeatedly emphasized the predictability of these cycles, allowing investors to anticipate the transition into the Banana Zone.

However, he cautions that while the general trend is foreseeable, the exact nature of market movements can vary.

6. Rate Cuts

Fred Kreuger also believes a rate cut is coming in September.

And to be fair, Polymarket has a September rate cut at an 84% chance.

A September rate cut would signal the beginning of multiple rate cuts down the line.

Fred even mentions that if Trump wins the presidency, we can expect these rate cuts to come in much faster. Predicting that we could even be at 2% by the end of next year.

“High rates bad. We’ve rallied in spite of high rates over the last year. But I think if you start cutting rates, wow, that really accelerates things.”

Low interest rates have always been a boost for risky assets, including crypto.

7.The Global Liquidity Cycle

Bitcoin and cryptocurrencies are highly correlated with global liquidity.

Based on the chart below, a late 2025 cycle peak is expected.

8. Ethereum ETFs Going Live

Spot Ethereum ETFs will launch today.

Experts like Bitwise’s Matt Hougan forecast $15 billion in inflows over the first 18 months.

This marks a major milestone for Ethereum and is another positive step for the crypto industry.

Ethereum is the first altcoin to achieve an ETF…

This might open the door for other crypto ETFs, such as Solana. 👀

These are substantial bullish factors…

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

OTHER NEWS:

Kraken Custody has launched its institutional services in the UK and Australia, 1st international move since its US debut in March. The expansion aims to offer secure storage and management solutions for digital assets. Kraken plans to extend its reach to other markets, including the EU and Switzerland.

OKX launches game as the Telegram mini-app craze continues. OKX Racer lets users predict Bitcoin’s short-term price movements in five-second intervals. Players earn points for correct guesses, which can be used for in-game upgrades and referral rewards.

Metaplanet boosted its Bitcoin holdings to 1 billion yen, driving a 19% surge in its stock price. The firm now holds 245.992 BTC, solidifying its strategy to follow in the footsteps of MicroStrategy. The company completed this purchase by acquiring an additional 20.38 BTC.

Trading on Polymarket surged past $300 million as the U.S. presidential election heats up. The market for the Democratic nominee hit $200 million, and another $10 million is wagered on the vice presidential pick. Biden's exit has driven unprecedented activity.

MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.