3 Ethereum ETF Inflow Predictions💥

ETF Inflow Update

What Is Ethereum?

And more…

Market Data Prices as of 5:50am ET

Price (USD) | Change (24h) | Change (YTD) | |

Bitcoin (BTC) | $64,241 | -2.35% | +51.94% |

Ethereum (ETH) | $3,180 | -7.53% | +39.40% |

Solana (SOL) | $170 | -1.50% | +67.93% |

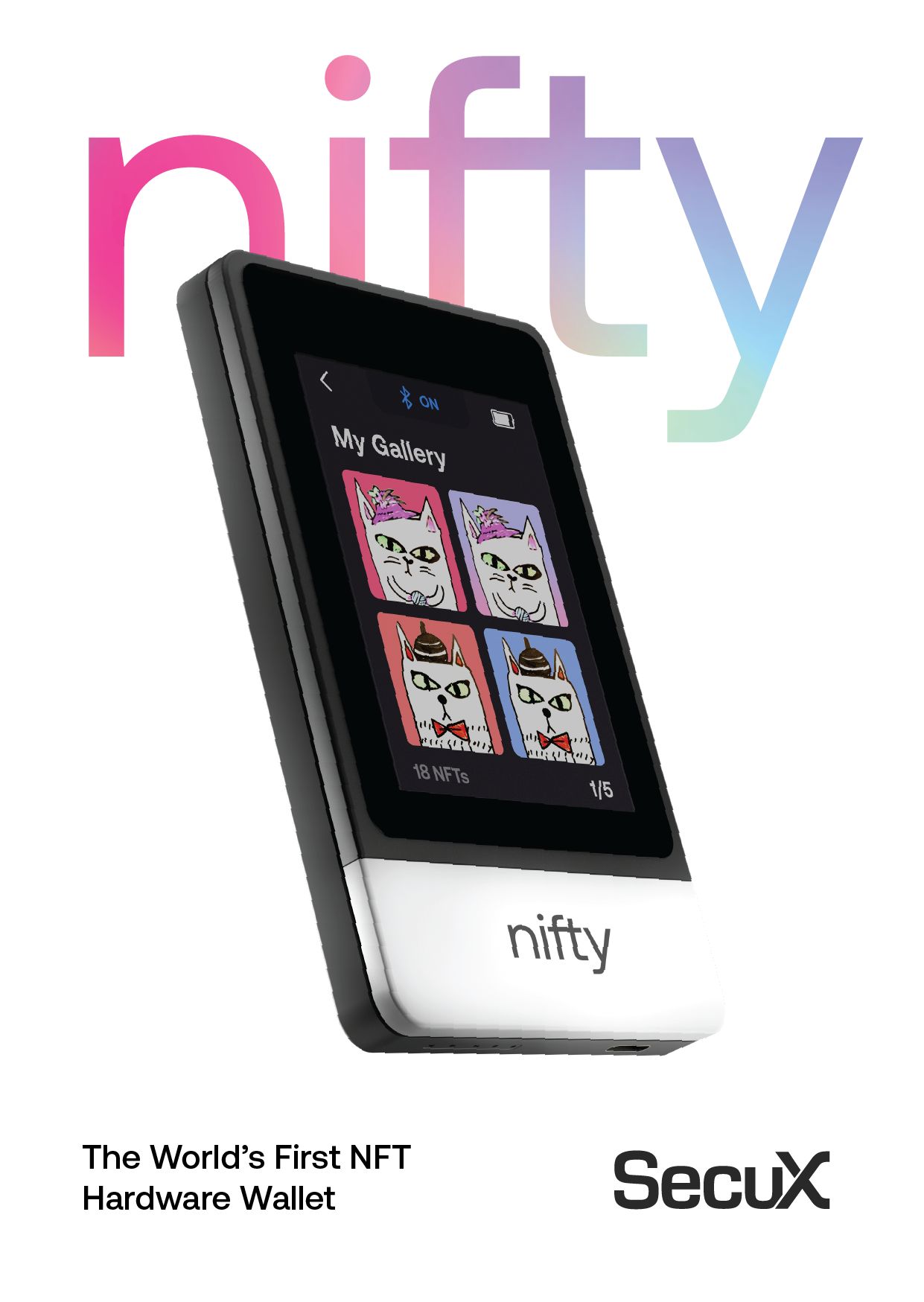

SecuX web and mobile apps help manage, send, and receive digital assets — anytime, anywhere

3 $ETH ETF INFLOW PREDICTIONS🔮

This week saw the moment we've all been eagerly anticipating.

The Ethereum ETFs started trading at 9:30am Eastern Time on July 23. 🥳

This comes after the SEC granted final approval on July 22, as confirmed by ETF analyst Eric Balchunas.

With the arrival of these ETFs, the big question on everyone’s mind is: How will these ETFs impact my the price of $ETH? 💰

To answer that, let’s dive into the $ETH inflow predictions from top crypto institutions: Galaxy Digital, Bitwise, JP Morgan, and more.

Here’s the TL;DR: (All % comparisons are based on $BTC ETF flows in their first 5 months of trading)

Bull Case: Inflows of $5B in 2024 (30% of $BTC ETFs)

Base Case: Inflows of $3B in 2024 (20% of $BTC ETFs)

Bear Case: Inflows of $1.5B in 2024 (10% of $BTC ETFs)

Keep reading for more details on each prediction (and how it could impact the price of $ETH 👀) ⬇️

1. Bull case

Alex Thorn, head of research at Galaxy Digital, predicts an inflow of 20-50% of the Bitcoin ETFs, which amounts to a approximate total of $5B by the end of 2024.

Bitwise has a similar end-of-year prediction but sees 2025 as an even bigger year for $ETH ETFs, with an approximate number of around $15BN over the course of the next 18 months.

Check out the prediction packed into a lively episode of The Milk Road Show with Matt Hougan (Bitwise CEO), where he discusses these ETFs in detail 🎧

2 Key Reasons why Galaxy Digital and Bitwise are so bullish:

Institutions will likely hold both $BTC and $ETH for diversified crypto exposure

Grayscale outflows for ETH are expected to be lower than those for Bitcoin

2. Base case

JP Morgan forecasts that $ETH ETFs will capture $3B in 2024 (20% of the inflows that $BTC ETFs experienced in their first 5 months of trading)

Other prominent voices, like the “Bloomberg Boys”, Eric and James, support JP Morgan’s outlook 👬

3. Bear case

Andrew Kang, co-founder of Mechanism Capital and notable figure on crypto Twitter, leads the more cautious viewpoint.

He predicts $1.5B in inflows for 2024 (10% of the inflows that $BTC ETFs saw in their first 5 months of trading).

3 Key Reasons behind his prediction:

Institutions favor $BTC over $ETH

The excitement around Spot $BTC ETFs was significantly higher than for Spot $ETH ETFs

$ETH ETFs are less appealing without staking options

Impact on $ETH?

The price of $ETH will be more reactive to ETF flows compared to $BTC, due to 40% of its supply being locked in staking and smart contracts. 🔒

While the future of $ETH over the next 5 months is uncertain, one thing is clear: Institutional inflows into $ETH are a long-term positive for the token. 💪

ETF INFLOW UPDATE

🥇 BlackRock It speaks volumes that BlackRock purchasing 1090 BTC in a single day now seems somewhat routine.

This was yesterday’s headline, inevitably struggling to compete with Monday’s standout performance.

🧮 Total The Bitcoin ETFs experienced negative flows yesterday, with 1180 Bitcoin sold, breaking a streak of twelve straight days of inflows.

BlackRock stood out as the only gainer amidst significant outflows from: Bitwise (1065 BTC), Ark (792 BTC), and Grayscale (414 BTC). Fidelity remained net neutral.

🔷 Ethereum On its first day, the Ether ETFs saw more than $1 Billion in traded volume and net flows of + $106M.

BlackRock had robust inflows of $266.5m, followed by Bitwise ($204m) and Fidelity ($71.3m), whereas Grayscale faced massive outflows.

This narrative seems all too familiar...

Join Swan Bitcoin! And Get $10 of Bitcoin When You Sign Up!

WHAT IS ETHEREUM? 🤔

The narrative for Bitcoin is straightforward: Digital Gold. It’s a tried-and-true concept that’s widely accepted.

When Bitcoin ETFs launched, financial leaders like Larry Fink pushed the Digital Gold narrative, helping Bitcoin achieve trillion-dollar status.

But with Ethereum ETFs entering the scene, there’s a new question: What’s the narrative for Ethereum?

Ethereum is more complicated. It’s like describing a multi-skilled friend who does a bit of everything. Ethereum is a smart contract blockchain with numerous use cases, not just a store of value like Bitcoin.

Some view Ethereum's lack of a single, clear narrative as a drawback, but we see it as a strength. Here’s why:

First, a look at Ethereum’s various narratives over time:

Decentralized App Store: Like Apple’s App Store, but decentralized.

Always-on Finance: Round-the-clock financial services. Ethereum operates beyond the traditional 9-5.

The Settlement Layer of the Internet: An internet-based settlement layer for transactions.

The World Computer: A concept from Ethereum’s early days.

Ultra Sound Money 🦇🔈: Bitcoin’s 21M supply cap makes it “sound money”; Ethereum’s deflationary supply makes $ETH ultra sound money.

Which narrative will TradFi leaders choose to market their ETFs? We’ll have to wait and see.

We argue that Ethereum’s multiple narratives are a feature, not a bug:

Diverse Accomplishments: A wide range of narratives showcases Ethereum’s capabilities, similar to the internet.

Upside Potential: Investing in an asset before its potential is fully recognized can be extremely profitable. Once Ethereum’s full potential is understood, its value might skyrocket.

Ethereum offers a vast array of opportunities, making it exciting despite its marketing challenges.

When asked what Ethereum is, simply reply, “It’s whatever you need it to be!”

So, get ready and enjoy the journey!

OTHER NEWS:

Metaplanet's buying spree and Mt. Gox test transactions follow Bitcoin's brief $68K climb. Bitcoin price hits $68,000 on President Joe Biden news, slips with Metaplanet buying spree and Mt. Gox test moves.

The Digital Chamber pens letter to Vice President Kamala Harris. The Digital Chamber, a cryptocurrency political advocacy group, has penned an open letter to potential 2024 Democratic presidential nominee Kamala Harris.

Ethereum ETFs Could See Underwhelming Demand, Two Research Firms Predict. Trading firm Wintermute expects inflows to be lower than consensus predictions.

Nicolas Dorier, BTCPay Server Developer, explores the potential of the Lightning Network to create a decentralized, untrusted Bitcoin-Dollar system, proposing an approach that could render stablecoins and traditional banking liabilities obsolete

Marconius Solidus, a privacy enthusiast, writes a thread that provides seven tips to enhance digital privacy and empower people to protect their online information effectively

David Bailey, Chief Marketing Officer for Azteco, explains why and how bitcoin needs to cross the chasm of consumer adoption through improved user experience, education, and practical applications that prioritize ease of use over technological complexity

Lyn Alden, an investment analyst, writes about the power of Nostr and its ability to enable users to control their digital identities, seamlessly transfer content and followers across platforms and facilitate a better payment experience on Bitcoin

TOP MEMES OF THE WEEK

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.